Tether’s USDT has long held its position as the leading stablecoin by market capitalization, and recent announcements indicate that it may maintain its dominance with even further growth.

Throughout this year, USDT’s market capitalization has been on a consistent upward trend, recently surpassing a significant milestone. The noteworthy aspect is that it has now exceeded its previous all-time high achieved in 2022. According to IntoTheBlock’s analysis, USDT’s market capitalization has grown by approximately 30% year-to-date.

Tether's supply and market capitalization have hit new highs this month, approaching the noteworthy $84B benchmark. The circulating supply of USDT is up nearly 30% year-to-date#Tether #Stablecoin #USDT pic.twitter.com/BPugfiZZl4

— IntoTheBlock (@intotheblock) July 28, 2023

On 21 July, USDT’s market capitalization peaked at an impressive $83.83 billion, considerably higher than its 2022 peak, which was just above the $83.20 billion mark. This substantial growth is evident in the charts.

Source: Santiment

Typically, market capitalization growth reflects the price performance of most digital assets. However, this is different for stablecoins due to their fixed prices. Nonetheless, it still indicates the amount of capital worth or the value of the stablecoin available.

While some may view USDT’s expanding market capitalization as a sign of an improving market, it doesn’t necessarily imply an incoming bullish move. However, there might be a grain of truth in considering it a half-truth, as market capitalization growth could suggest Tether’s preparation for increased demand.

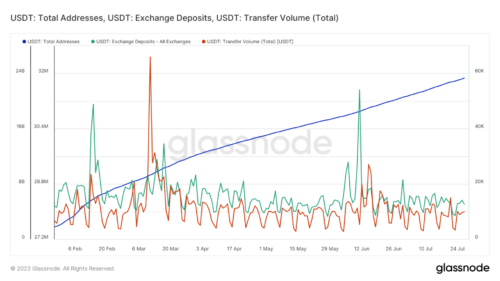

To gain insight into the demand dynamics, examining certain metrics for USDT might be helpful. Stablecoins serve as mediums for accessing cryptocurrencies, so a surge in volume could indicate more on-chain activity and potentially higher demand. Yet, this isn’t reflected in Bitcoin’s transfer volume, which has remained near its six-month low range.

USDT’s exchange volumes have also declined considerably compared to their peaks in the past six months. However, one crucial metric that underscores USDT’s current state is the total number of addresses, which has been on a steady upward trajectory. This indicates that stablecoin is experiencing growth in terms of user numbers.

Source: Glassnode

The reason for this observed growth could be attributed to Tether’s expanding suite of products, such as Tether Gold, which is pegged to the value of gold. These additional products have been supporting USDT transactions and contributing to its overall success.