Tether (USDT), the leading stablecoin, witnessed a remarkable surge in transaction volume, reaching a two-month high. In a single day, its 24-hour volume skyrocketed from $12 billion to an impressive $47 billion. This surge was ignited by false reports regarding the approval of a spot Bitcoin ETF, driving market fervor.

Tether’s Rise Amid ETF Excitement

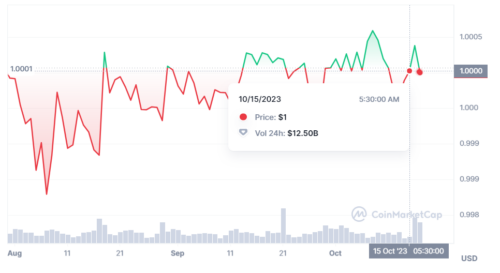

The surge in Tether’s volume was evident, with Santiment reporting a two-month high in on-chain activity. According to CoinMarketCap data, its 24-hour market volume surged by 290%, rising from $12 billion on Sunday to nearly $38 billion on Tuesday and Wednesday. This surge reflects the heightened interest in spot Bitcoin ETFs, as investors turn to stablecoins to safeguard their capital during volatile market movements.

USDT 1-day volume

Whale Wallet Accumulation

Notably, during this surge, Santiment observed an accumulation in Tether’s largest whale wallets. The top 10 largest Tether wallets now collectively hold a quarter of the entire USDT supply. Tether currently boasts a circulating supply of 83.6 billion USDT.

Tether’s October Celebration

October, historically considered a bullish month, is also known as ‘Uptober’ in the crypto community. This month marks the 9th anniversary of Tether’s creation in October 2023. As of now, Tether’s market capitalization stands at $83.7 billion, according to CoinMarketCap data.

Positive Sign for the Crypto Market

Although Tether’s daily trading volume has experienced a 17% decrease compared to the previous day, the ratio of trading volume to market capitalization remains at 44%. The increased Tether volume serves as a positive indicator for the crypto market, signaling potential future crypto investments.