NFTs, or non-fungible tokens, have cemented their place in the crypto and creative industries as they have proven extraordinarily useful in art, music, and gaming. They are also now used in consumer markets for goods such as virtual real estate, etc. According to Verified Market Research, the NFT market is currently growing at a CAGR of 33.7%, and its valuation is projected to reach USD 231.98 Billion by 2030. Therefore, it’s almost a must to talk about it.

What Is Fungibility?

In economics, fungibility is the ability of a good or asset to be interchanged with other individual goods or assets of the same type. Cryptocurrencies and traditional currencies are generally fungible because their units can be traded or exchanged at equal values, whereas NFTs cannot. For example, you can change a 100-dollar bill to five 20-dollar notes just as you can share one bitcoin amongst ten friends, each getting 0.1 BTC. For NFTs, that’s not doable. Comprehensively, non-fungible tokens (NFTs) are tokens that we can use to represent ownership of unique items and cannot be broken into smaller pieces. They let us tokenize things like art, collectibles, and even real estate, but how did we get here?

A Brief History of NFTs

Before Ethereum became home to most NFTs, In May 2014, Kevin McCoy, a digital artist, minted the first NFT ever on the Namecoin blockchain, Quantum. Quantum was created by Kevin and his wife, Jennifer, as a digital image of a pixelated octagon that hypnotically changes color and pulsates in a manner reminiscent of an octopus. At that time, Kevin sold it to tech entrepreneur Anil Dash for only $4. NFTs are now sold for hundreds of thousands of dollars with the most expensive one sold for $91.8 million in 2021. NFTs have indeed come a long way.

Since NFTs went mainstream around 2017, most of the NFT collections launched on the Ethereum blockchain. Ethereum made trading and transfer of ownership of NFTs impressively easy. It became the game changer in the NFT world. Its network and smart contracts, which conform with ERC-721 or ERC-1155 standards enabled token creation, programming, storage, and trading built directly into the blockchain itself. These features perfectly eased the onboarding process and increased access. There are now tens of thousands of NFT collections on the Ethereum blockchain.

Crypto Punks

One of the earliest Ethereum NFT projects was CryptoPunks, a collection of 10,000 unique collectible characters with proof of ownership. a collection of 10,000 unique collectible characters with proof of ownership. It was launched by Larva Labs in 2017. It was an incredibly successful project; many of its pieces have sold for millions.

Characteristics of NFTS

The common features of NFTs are as follows:

Uniqueness: NFTs are usually stored in tokens metadata. They are unique in their character, and no two NFTs are the same. Uniqueness is the main essence of their fungibility.

Indivisibility: Most NFTs cannot be split into smaller denominations like cryptocurrencies. You cannot buy or transfer a fraction of an NFT the way you can purchase and transfer a fraction of Bitcoin.

Tradability: Anyone with access to the internet and some gas fee can sell, buy and transfer NFTs on specialized marketplaces and trading platforms like OpenSea and Magic Eden.

Digital Asset: NFTs are generally digital items representing internet collectibles like art, music, and games with an authentic certificate created on a blockchain. A tweet can even be minted as an NFT. In 2021, Crypto entrepreneur Sina Estavi bought Twitter founder Jack Dorsey’s first-ever tweet as an NFT for $2.9 million. The major factor that makes an NFT valuable is scarcity.

How NFTs Work

First up, it’s essential to understand the difference between NFTs and the digital items whose ownerships they secure. For example, an artist can create a piece of art and decide to represent its ownership with a blockchain-based token to prevent his work from being counterfeited, forged or replicated. That blockchain-based token is the NFT, not the art, however before creating your NFT you will want to choose a standard to follow.

Creating NFTs

NFTs are created through a process called minting, where information about the NFT is recorded on a blockchain to establish its immutable record of authenticity and ownership. This minting process often entails incorporating smart contracts that assign ownership and manage the transferability of the NFT.

To obtain an NFT, you either buy it from somebody or mint it. Minting an NFT requires creating something completely new, the item to be minted and the cryptocurrency, usually Ether, that is necessary to pay the gas fee. A gas fee is just a blockchain transaction fee paid to network validators for their services to the blockchain. NFT transactions such as buying, selling, and transferring always attract a gas fee.

NFT data also has to be stored digitally since the token is a certificate of ownership that points to the actual data. There are many ways to store NFT data digitally, but IPFS (Intepalentarry File System) is the most popular way.

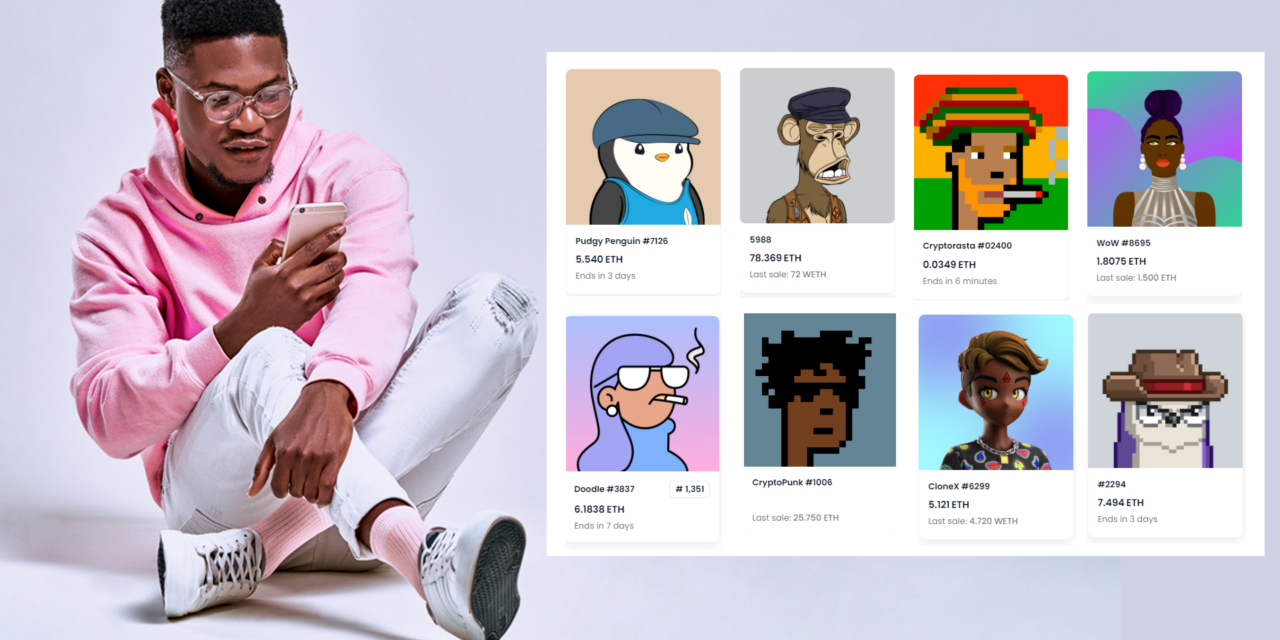

Trading NFTs

Trading NFTs, on the other hand, requires buying an existing item that has been minted into an NFT by someone else. Minting, purchasing, and storing of NFTs all take place on NFT marketplaces. To use an NFT marketplace, you will need a crypto wallet to store and trade your best NFT tokens. OpenSea, Rarible, SuperRare, Foundation, AtomicMarket, etc., are examples of NFT marketplaces.

Use Cases of NFTs

Crypto Rasta

NFTs have numerous use cases. The following are some common ones:

Art: With NFTs, digital artists are now able to protect their art creations from copyright infringement. NFTs provide proof of ownership, authenticity, and eliminate issues of counterfeiting, intellectual property theft and fraud.

Music: The rise in popularity of Crypto Rastas demonstrates that music is one of the most common use cases for NFTs. A group of musicians and artists known as the Crypto Rastas use blockchain technology to sell their music and merchandise through NFTs. By doing this, they can maintain complete control and ownership over their digital works and provide their audience with a distinctive, verifiable, and collectible experience. NFTs that grant fans unique access to music, products, or other digital content are available for purchase and can also be sold on the open market. In addition to bringing greater transparency and security to the music industry, the use of NFTs has given Crypto Rastas a fresh and creative way to sell their work and engage with listeners.

Collectibles: Several companies now leverage NFTs by developing platforms where people can buy, sell, or trade collectible items minted as NFTs. These items can range from digital art to physical goods like baseball cards and action figures. CryptoKitties is a perfect example of NFT collectibles. They are virtual cats that can be bred and traded.

Gaming: NFTs are thriving in the gaming industry. There has been a massive crossover between traditional gaming companies and decentralized startups, as both sides look to capitalize on digital cards, artwork, and even fashion on the blockchain. Companies like Ubisoft, Take-Two, Epic Games, and Square Enix have embraced the idea of developing games with in-game assets and cosmetics as NFTs.

Fashion: The fashion industry is included in the growing adoption of NFTs. Fashion NFTs can take different forms. They include virtual wearables that customers can wear within virtual environments like the metaverse, digital content with which owners can interact and even digital twins of physical creations. Many high-fashion designer brands appear to be using NFTs to appeal to the younger generation of digital natives.

Conclusion

Despite witnessing significant downturns, the NFT industry has come a long way since it went mainstream in 2017. Its surge in popularity and adoption is as impressive as it is dramatic, particularly because most people find it hard to understand why millions of dollars are pumped into buying proof of ownership. It’s hard to tell what the future has in store for NFTs, but if anything, they are not a fad.

By Abdulfatai Morakinyo

Senior Editor, Senit University