Yes, DeFi rhymes with sci-fi, but unlike the latter, it’s not in the slightest fictional. It’s as real as you and me, indeed, and the very future of finance. Decentralized Finance offers financial instruments without relying on intermediaries such as banks, brokerages, or exchanges using smart contracts on a blockchain. Therefore, it makes perfect sense that before being commonly known as DeFi, it was known as open finance.

Like sci-fi, DeFi is a portmanteau word pronounced dee-fai. It’s a blend of the words “decentralized” and “finance.” Simply put, DeFi means decentralized finance. DeFi has been widely embraced by the cryptocurrency industry, so much so that a recent report by Statista indicates that Decentralized Finance users grew by 300,000 since early 2022, less than half the increase during the same period in 2021. You most likely know all the dictionary meanings of finance as a word but probably still can’t wrap your head around decentralization from a finance perspective. Just read on! There are answers in this article.

Decentralization in the Context of Finance

Decentralization as a concept does not only exist in DeFi. It also has use cases in politics, management, traditional insurance, and so forth, but our focus is different in this article. We’ll be discussing the finance side of things. It’s safe to say that DeFi is a core part of Web3—a massive ecosystem and generation of the internet that thrives on blockchain technology. It’s essential to know that it’s almost impossible to change anything stored on a blockchain because once it’s stored, it becomes immutable.

According to Investopedia, Decentralized Finance (DeFi) is an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies. It challenges the traditional centralized banking system by eliminating intermediation, reducing the fees banks and other financial companies charge for using their services, and promoting peer-to-peer, or P2P, transactions.

Jeremy Allaire, Circle’s CEO, once said, “DeFi provides internet-native alternatives to popular financial services in the form of decentralized protocols on a blockchain. Essentially, what that means is that anyone with an internet connection can take part in the global financial system, even if they don’t have a bank account.”

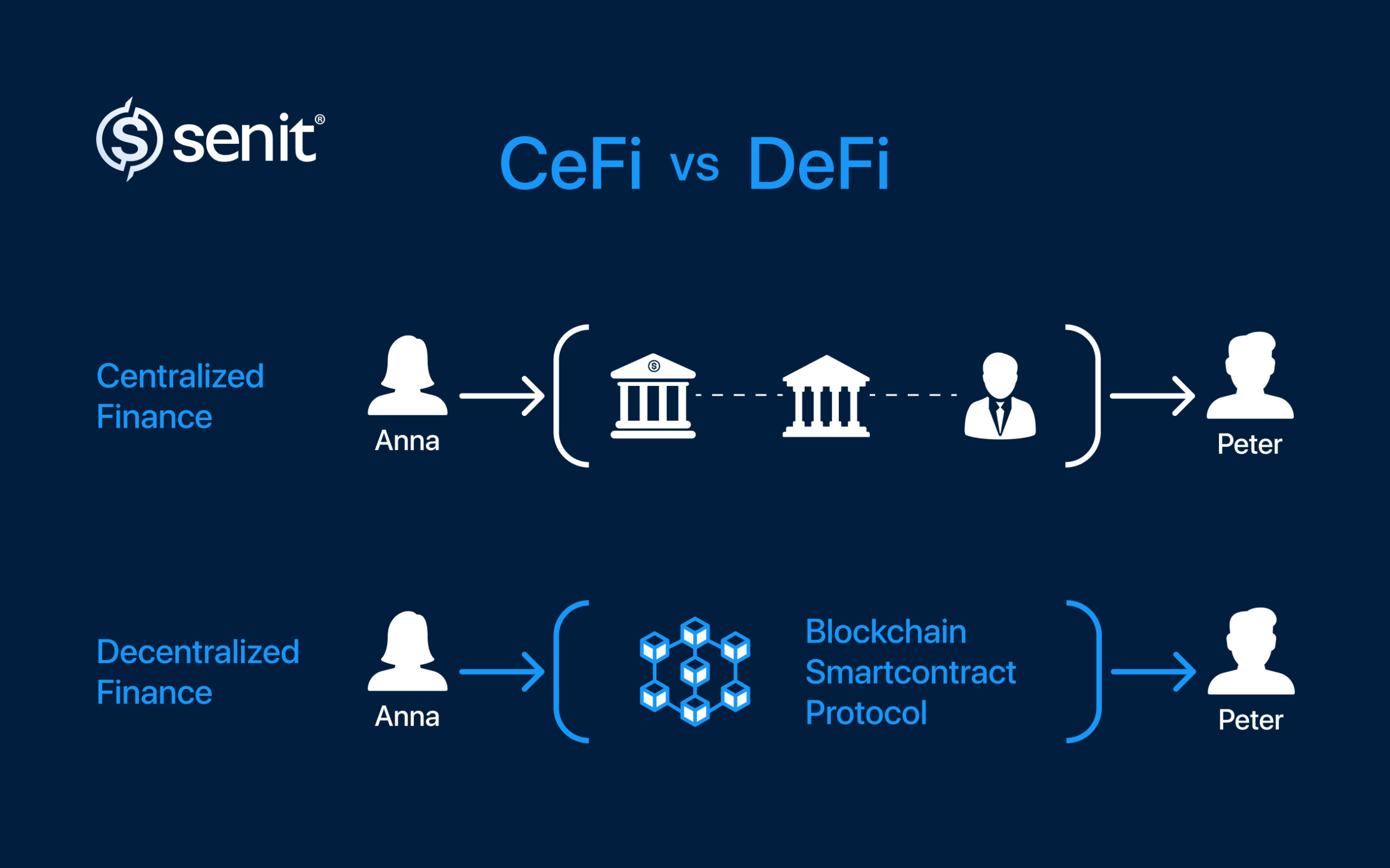

You can think of decentralization in the context of finance as taking out central bodies (government, banks, etc.) who act as authorities out of the picture of finance and giving the actual people who are directly involved with it the ability to operate and transact seamlessly without intermediaries. Generally, these central authorities are banks, brokerages, and centralized exchanges, this process is known as CeFi or Centralized Finance. The question now is how do DeFi projects manage to replace banks and brokerages from the CeFi ecosystem that are supposed to be intermediaries. The answer is not far-fetched in the slightest.

How DeFi Works

The ultimate goal of all DeFi projects is the elimination of intermediaries, but someone or something (in this case) else has to play the intermediary. That thing is a smart contract, and it thrives on blockchain technology which was first adopted by the first and most popular cryptocurrency, Bitcoin.

Investopedia defines a smart contract as a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code. The code and the agreements contained therein exist across a distributed, decentralized blockchain network. The code controls the execution, and transactions are trackable and irreversible.

Smart contracts effectively remove the human factor from decision-making. A common saying that is often mentioned in smart contract discourses is “Code is law.” It’s a saying that encapsulates the whole essence of smart contracts, given that their codes are written with if-then semantics to automatically process all kinds of transactions without the input of a middleman. These codes are usually stored on the blockchain (you can read as a chain of blocks) to make them secure and trustless. The applications built upon smart contracts, such as Uniswap, Pancake Swap, AAVE, etc., are called dApps.

The Ethereum DeFi Ecosystem

Ethereum, although mostly known for its native cryptocurrency, Ether, is a decentralized open-source blockchain with smart contract functionality. It’s a smart contract deployer designed to be scalable, trustless, secure, programmable, and decentralized. It is the go-to blockchain for developers and enterprises looking to build functional dApps.

Ethereum is a general-purpose blockchain, and that’s why it’s not surprising that it has over 150 DeFi projects in its ecosystem alone. Successful DeFi projects such as Uniswap, MakerDAO, 1Inch, AAVE, etc., are some of the projects built on it. The platform’s super innovative architecture of its blockchain birthed concepts like NFTs, GameFi, and the Metaverse.

Use Cases of DeFi

Decentralized finance is a multifaceted concept with many use cases one could call macro categories. Here are five of them:

- Asset Management: Users of dApps like MetaMask are the custodians of their digital assets. They now have much more control over how every bit of their asset is used. The transactions that take place on DeFi platforms with this use case are seamless because everything is automated through smart contracts. Asset management can be used for the storage of both tokens and NFT’s.

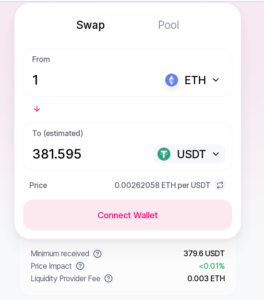

- Decentralized Exchanges (DEXs): Exchanges can either be centralized or decentralized. As you might already know, if it’s centralized, it means there’s a central authority that serves as an intermediary, but if it’s not, an autonomous smart contract does the job. DEXs rely solely on autonomous smart contracts to conduct transactions between their users in a trustless environment without users filling out any KYC forms beforehand. Platforms like Uniswap, Pancake Swap, SushiSwap, etc., are popular DEXs.

- Borrowing and Lending dApps: On decentralized platforms like Compound and Aave, you can lend and borrow cryptocurrencies the same way money is lent and borrowed in the real world. The only difference with DeFi loans is that no bank or agent is involved; the loan agreement is embedded in the platform’s smart contracts. However, DeFi loans are often overcollateralized due to the volatility of the crypto coins usually involved. This benefits lenders in form of interests.

- Insurance dApps: Having peace of mind is essential in any business venture. With the use of decentralized insurance platforms like Mutual, Nexus, and Etherisc, anyone who’s insured their assets will be safe any time, any day. Investors in crypto-based projects can rest assured DeFi insurance would cover the eventuality of a hack or even a bug on a smart contract.

- Decentralized Autonomous Organizations (DAOs): Ethereum defines a DAO as a collectively-owned, blockchain-governed organization working towards a shared mission. With DAOs, we can create an organization that will be run on lines of code, determining how the organization works and how funds are spent. DAOs leave no room for fraud. DAOs are fully democratized and are perfect for building organizations with people one can or cannot trust completely. A smart contract is needed for all the automation required for a DAO to operate.

Stablecoins as a Cornerstone for DeFi

Undoubtedly, all the great things that have been achieved with DeFi would only have been achieved with stablecoins, particularly the ones tied to dollar reserves. Stablecoins are cryptocurrencies whose value is pegged, or tied, to that of another currency, commodity, or financial instrument.

Stablecoins, unlike other cryptocurrencies, are not volatile since they’re pegged to another currency, mainly the US dollar. USDC, EUROC, USDT, TUSD, and BUSD, for example, are all backed by US dollar reserves and are denominated at parity with the USD. PAXG, another stablecoin, is pegged to the value of gold. Whether the a is pegged to the price of gold or at parity with the US dollar, it enables investors to generate yield on their crypto assets in the DeFi market while alleviating the potential adverse effects of market volatility. They are the backbone of DeFi.

Conclusion

Undoubtedly, the DeFi industry is still burgeoning and, like any technology, could be better. There’s still room for more improvements and innovations in the space. Crypto enthusiasts, venture capitalists, and angel investors can take advantage of its perks as it grows.

By Abdulfatai Morakinyo

Senior Editor, Senit University