In a recent update from Glassnode, it has been revealed that the number of Bitcoin wallet addresses holding at least one BTC has exceeded the remarkable milestone of one million.

The surge in the number of wallet addresses holding one Bitcoin or more was particularly notable during a period of intense market volatility. Notably, significant spikes were observed during a market crash in June and following the collapse of FTX, which subsequently filed for bankruptcy on November 11.

Over the past year, as the price of Bitcoin experienced a decline of more than 65%, approximately 190,000 new “wholecoiners,” as they’re called, were added to the ecosystem. These additions occurred from early February 2022, coinciding with the decrease in Bitcoin’s value from its peak in November 2021.

Number of Bitcoin wallets holding more than 1 Bitcoin since inception. Source: Glassnode.

Sharing insights with his 54,000 followers on Twitter, Negentropic, co-founder of Glassnode, suggested that the ideal time to buy Bitcoin is when there is “blood in the streets.” This statement comes amidst major bank collapses in the United States and the possibility of the Federal Reserve pausing interest rate hikes in the near future. Glassnode remains confident that Bitcoin could reach a price of $35,000 in the mid-term due to these factors.

"Buy when there is Blood in the streets."

📉$25.8k still remains a possibility, as indicated by the options market

🔮 Confident in our mid-term outlook of $35k as external pressures subside.

💼 Market pricing Fed pause in June, no rate cut – optimal for the run to $35k for… pic.twitter.com/xBnIyHK5A0

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) May 12, 2023

However, it’s important to note that a single Bitcoin wallet address does not necessarily represent an individual user. Many crypto investors maintain multiple Bitcoin addresses, and additional addresses are attributed to prominent institutions such as cryptocurrency exchanges and investment firms, which typically hold substantial amounts of Bitcoin.

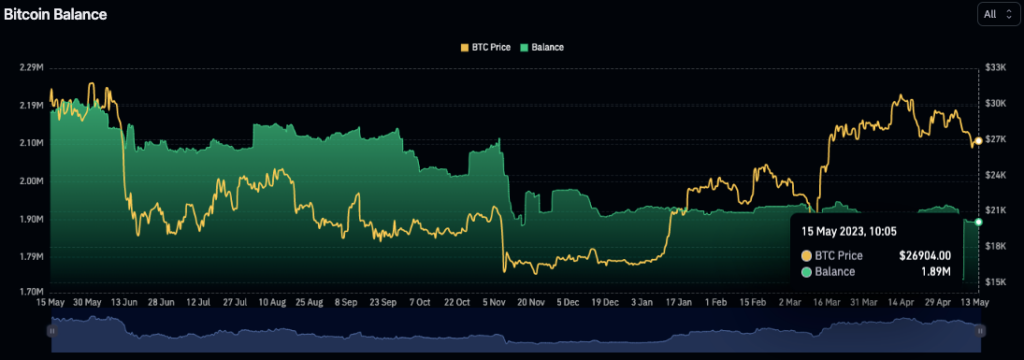

According to data from CoinGlass, a leading crypto analytics provider, out of the approximately 19 million Bitcoin currently in circulation, around 1.89 million BTC (equivalent to $50.7 billion) are held on major centralized exchanges like Binance and Coinbase.

The total number of Bitcoin held on centralized exchanges. Source: CoinGlass

Additionally, Glassnode estimates that a staggering 3 million BTC, valued at $80.4 billion and accounting for 17% of the total circulating supply, are considered “lost forever.” This figure includes BTC sent to “burn addresses,” wallets with lost keys, and large dormant accounts that have remained untouched for over a decade.

The attainment of the “one million” milestone is an important record; however, it’s crucial to consider the diverse nature of Bitcoin ownership and the presence of institutional holdings and lost coins within the ecosystem.